Do Both Owners Have To Apply For Homestead Exemption In Florida . Greg, here in the state of florida, when you have multiple owners of a piece of property and they. The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. The exemption is subtracted from the. Florida homestead properties receive up to a $50,000 exemption from property taxes. Application of homestead exemption on classified use properties. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. The save our homes act.

from www.exemptform.com

The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. The save our homes act. Application of homestead exemption on classified use properties. Florida homestead properties receive up to a $50,000 exemption from property taxes. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Greg, here in the state of florida, when you have multiple owners of a piece of property and they. The exemption is subtracted from the.

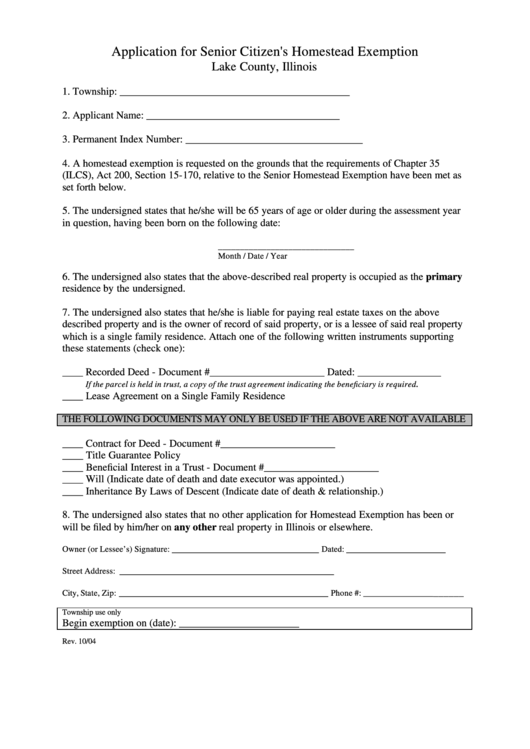

Application For Senior Citizen S Homestead Exemption Lake County

Do Both Owners Have To Apply For Homestead Exemption In Florida Application of homestead exemption on classified use properties. The save our homes act. Florida homestead properties receive up to a $50,000 exemption from property taxes. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. Application of homestead exemption on classified use properties. The exemption is subtracted from the. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Greg, here in the state of florida, when you have multiple owners of a piece of property and they. The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the.

From juradolawfirm.com

Do Both Owners Have to Apply for Homestead Exemption in Florida Do Both Owners Have To Apply For Homestead Exemption In Florida The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. Application of homestead exemption on classified use properties. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. Florida homestead properties receive up to a $50,000 exemption from property taxes. The exemption is subtracted from the.. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.youtube.com

Homestead Exemption for Florida Home Owners YouTube Do Both Owners Have To Apply For Homestead Exemption In Florida The save our homes act. The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Application of homestead exemption on classified use properties. Florida homestead. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.youtube.com

Homestead Exemption FLORIDA YouTube Do Both Owners Have To Apply For Homestead Exemption In Florida Application of homestead exemption on classified use properties. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Florida homestead properties receive up to a $50,000 exemption from property taxes. The save our homes act. Greg, here in the state of florida, when you have multiple owners. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.stiverfirst.com

File for Homestead Exemptions… Rotonda West and Englewood Real Estate Do Both Owners Have To Apply For Homestead Exemption In Florida 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. Florida homestead properties. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.formsbank.com

Application For Homestead Property Tax Exemption Form printable pdf Do Both Owners Have To Apply For Homestead Exemption In Florida 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. The save our homes act. The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. On may 6, 2022, the governor approved chapter 2022‐97, laws. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.manausa.com

How To File For The Homestead Tax Exemption • Property Tax Tallahassee Do Both Owners Have To Apply For Homestead Exemption In Florida On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. Application of homestead exemption on classified use properties. The save our homes act. The exemption is subtracted from the. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Florida homestead properties receive up to. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.youtube.com

Florida Homeowners Homestead Tax Exemption and transferring it to a new Do Both Owners Have To Apply For Homestead Exemption In Florida The save our homes act. The exemption is subtracted from the. The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. Application of homestead exemption on classified use properties. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. Greg, here in the state of florida,. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From juradolawfirm.com

Do Both Owners Have to Apply for Homestead Exemption in Florida Do Both Owners Have To Apply For Homestead Exemption In Florida Greg, here in the state of florida, when you have multiple owners of a piece of property and they. The exemption is subtracted from the. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. The. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From formdownload.org

Free Application Forms PDF Template Form Download Do Both Owners Have To Apply For Homestead Exemption In Florida The exemption is subtracted from the. Application of homestead exemption on classified use properties. Florida homestead properties receive up to a $50,000 exemption from property taxes. The save our homes act. Greg, here in the state of florida, when you have multiple owners of a piece of property and they. The florida constitution does not restrict the type of property. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.formsbank.com

Fillable Original Application For Homestead And Related Tax Exemptions Do Both Owners Have To Apply For Homestead Exemption In Florida Florida homestead properties receive up to a $50,000 exemption from property taxes. The save our homes act. The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. Application of homestead exemption on classified use properties. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. The. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From future.loans

How to File for Homestead Exemption in North Florida Future Home Loans Do Both Owners Have To Apply For Homestead Exemption In Florida On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. The save our. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.exemptform.com

Florida Homestead Exemption Form Broward County Do Both Owners Have To Apply For Homestead Exemption In Florida Florida homestead properties receive up to a $50,000 exemption from property taxes. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. Greg, here in the state of florida, when you have multiple owners of a piece of property and they. Application of homestead exemption on classified use properties. The exemption is subtracted from the. The florida constitution. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.har.com

New Homeowners It's Time to File Your Homestead Exemption! Do Both Owners Have To Apply For Homestead Exemption In Florida The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. The exemption is subtracted from the. The save our homes act. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Greg, here in the. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.uslegalforms.com

FL Lineal Heir Homestead Density Exemption Application Levy County Do Both Owners Have To Apply For Homestead Exemption In Florida The florida constitution does not restrict the type of property ownership required to qualify for the homestead exemption, only requiring that the. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. Application of homestead exemption on classified use properties. Florida homestead properties receive up to a $50,000 exemption from property taxes. Greg, here in the state of. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.signnow.com

Homestead Exemption Complete with ease airSlate SignNow Do Both Owners Have To Apply For Homestead Exemption In Florida On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. Application of homestead exemption on classified use properties. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Florida homestead properties receive up to a $50,000 exemption from property taxes. Greg, here in the state. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.core-wm.com

Florida Homestead Exemption Fee Only, Fiduciary, Financial Planning Do Both Owners Have To Apply For Homestead Exemption In Florida The exemption is subtracted from the. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Application of homestead exemption on classified use properties. On may 6, 2022, the governor approved chapter 2022‐97, laws of florida,. The florida constitution does not restrict the type of property ownership. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From www.firsthomehouston.com

How to Apply for Your Homestead Exemption Plus Q and A — First Home Do Both Owners Have To Apply For Homestead Exemption In Florida Application of homestead exemption on classified use properties. The exemption is subtracted from the. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Florida homestead properties receive up to a $50,000 exemption from property taxes. Greg, here in the state of florida, when you have multiple. Do Both Owners Have To Apply For Homestead Exemption In Florida.

From formspal.com

Homestead Exemption Application PDF Form FormsPal Do Both Owners Have To Apply For Homestead Exemption In Florida Greg, here in the state of florida, when you have multiple owners of a piece of property and they. Application of homestead exemption on classified use properties. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Florida homestead properties receive up to a $50,000 exemption from. Do Both Owners Have To Apply For Homestead Exemption In Florida.